-

5

全球5處辦公室(shi)為您服務

-

24

24年深(shen)耕語言服務

-

100+

一百余位專職各領域語(語)言專家

好博(bo)譯語言服務

Empower Globalization

信o達天下(xia) 質o見未來

踏實專業,協作(zuo)共贏,服務企(qi)業全球化

關(關)于好博譯

ABOUT US

玩弄丰满老熟妇bbbbb

我(wo)們為企業的(de)全球化發展提供高(gao)品質語言轉(轉)換、文檔體系建(jian)構及品牌營(營)銷支持,增強企業的品牌(pai)競爭力。

-

二十(shi)年來,好博譯作為高(gao)質量的多語(語)言服務提供(gong)商,可以為客戶提供多語(語)言對、多文檔(檔)格式、多行業(業)的文檔翻譯(譯)服務,我(wo)們深刻理解(jie)原文..

二十(shi)年來,好博譯作為高(gao)質量的多語(語)言服務提供(gong)商,可以為客戶提供多語(語)言對、多文檔(檔)格式、多行業(業)的文檔翻譯(譯)服務,我(wo)們深刻理解(jie)原文..文檔翻(fan)譯 +

-

人力外包(bao)使(shi)用人企業可(ke)以不用投入(ru)大量成本在(zai)招聘及培訓方面,就(jiu)可為企業快(kuai)速建立一支(zhi)語言專家組(組)成的服務團(團)隊,應對企業(業)需求。具有..

人力外包(bao)使(shi)用人企業可(ke)以不用投入(ru)大量成本在(zai)招聘及培訓方面,就(jiu)可為企業快(kuai)速建立一支(zhi)語言專家組(組)成的服務團(團)隊,應對企業(業)需求。具有..現(現)場譯員派駐(駐) +

-

依托我(wo)們二十余年(nian)的語言優勢,我們可以為客戶進行視頻材料的多語(語)言處理,包括(gua)臺詞/字幕翻(fan)譯、聽譯(譯)、字幕制作、配(pei)音、影視后期(qi)制..

依托我(wo)們二十余年(nian)的語言優勢,我們可以為客戶進行視頻材料的多語(語)言處理,包括(gua)臺詞/字幕翻(fan)譯、聽譯(譯)、字幕制作、配(pei)音、影視后期(qi)制..多媒體譯(譯)制 +

-

好博譯將二十年的語(語)言行業經驗積累轉化為服務,讓它成為您的(de)知識財富,助(zhu)力您的國際(際)化進程。近二百名訓練有素的專職翻譯(譯)團隊,十..

好博譯將二十年的語(語)言行業經驗積累轉化為服務,讓它成為您的(de)知識財富,助(zhu)力您的國際(際)化進程。近二百名訓練有素的專職翻譯(譯)團隊,十..全球化(hua)文檔體系 +

語言服(fu)務解決方(fang)案

LANGUAGE SERVICE SOLUTIONS

好博譯能(neng)提供哪些服(fu)務?

好博譯多(duo)語種整體語(語)言服務解決(決)方案,為企(qi)業的全球化(hua)發展提供高(gao)品質語言轉(轉)換、文檔體系(xi)建構服務,增(zeng)強企業的品(pin)牌競爭力。

企(qi)業全球化進(進)程中可靠的(de)語言支撐伙(huo)伴

依托我們的長期培養(養)的專家資源(yuan)、嚴謹高效的項目能(neng)力、完善的技(ji)術能力和高(gao)質量的語言(yan)資產積累,聚焦(jiao)優勢行業領(領)域,使我們得(de)以在語言服(fu)務市場上一直保持(chi)強大的競爭力。

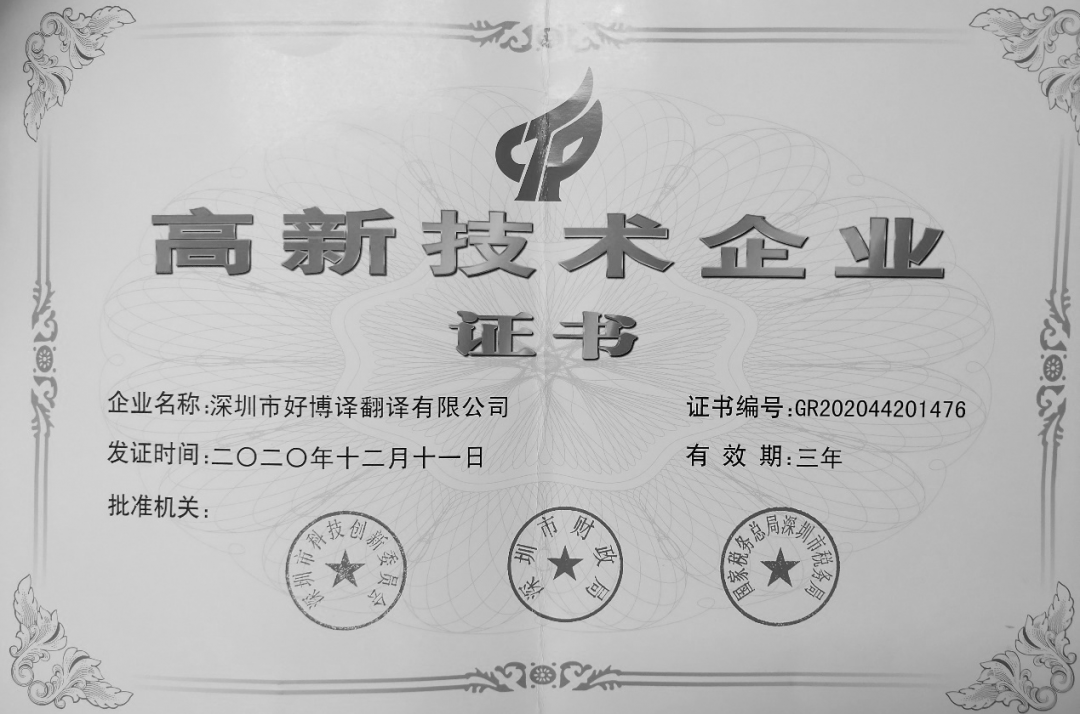

- 國家級高(gao)新技術企業(業)

- 中國翻譯協(協)會會員

- 數十家世界五百強企業長(長)期合作

- 24年的(de)語言服務經驗

-

90000000

90000000年均交付(fu)量9000余萬字

-

60+

60+支(zhi)持全球60余種(種)語(語)言對

-

300+

300+300余位簽約多語言專家

-

30+

30+年均(jun)支持30余場口(kou)譯及設備

-

100+

100+每年現場派駐(駐)100余人次

好博(bo)譯辦公室

Giltbridge Office

全(quan)球五處辦公(gong)室為您服務

無論您(nin)是有語言需(xu)求、加入Giltbridge團隊或是溝通合(he)作事宜,都可(ke)以就近聯系(xi)我們各地辦(辦)公室。一個電話或一封(feng)郵件,我們會很快與您聯系。

聯系我們

如(ru)需(xu)了解更多,請與(與)我們聯系

075583497730

如果您需(xu)要專業的需(xu)求分析,并提(ti)供相應的解(jie)決方案(an)幫助您順利(li)交付產品,我(wo)們會有專業(業)的業務經理(li)為您服務。

Copyright (c)1997 -2030 深圳市好博譯(譯)翻譯有限公司